Donating your car to veteran-focused organizations can have a significant impact on the lives of those who have served our country. By contributing a vehicle, you can provide essential transportation, generate funding for critical support services, and show your appreciation for the sacrifices made by our nation’s heroes. In this comprehensive guide, we’ll explore the top programs for donating your car to veterans, the benefits of such donations, and the step-by-step process to ensure your contribution makes the greatest difference.

Benefits of Donating Your Car to Veterans

1. Supporting Critical Veteran Services

When you donate your car to a veteran-focused organization, the proceeds from the sale of your vehicle can be used to fund a wide range of essential services and programs. This includes providing access to medical care, housing assistance, job training, educational opportunities, and mental health resources. By giving your car, you’re directly contributing to the well-being and empowerment of those who have served.

| Service | Description |

|---|---|

| Medical Care | Access to specialized healthcare, including physical and mental health treatments |

| Housing Assistance | Transitional and long-term housing solutions for veterans in need |

| Job Training | Skills development and employment opportunities to support financial independence |

| Educational Programs | Scholarships, vocational training, and career development initiatives |

| Mental Health Support | Counseling, therapy, and community-based resources for veterans and their families |

2. Providing Essential Transportation

Many veterans face mobility challenges, whether due to disability, limited income, or lack of access to reliable transportation. By donating your car, you can help address this critical need and ensure that veterans have the means to get to medical appointments, job interviews, educational institutions, and other important destinations. This can significantly improve their quality of life and facilitate their reintegration into civilian society.

- Improved access to essential services

- Increased independence and self-sufficiency

- Reduced reliance on public transportation or ride-sharing services

3. Generating Sustainable Funding

The sale of donated vehicles provides a reliable and ongoing source of revenue for veteran-focused organizations. This allows them to expand their reach, enhance the quality and breadth of their programs, and ensure the long-term sustainability of their operations. Your car donation can have a lasting impact, contributing to the continuous support and empowerment of those who have served.

- Stable funding for veteran-focused initiatives

- Ability to scale and improve existing programs

- Ensuring the longevity of essential services

4. Tangible Expression of Gratitude

Donating your car to a veteran-focused organization is a tangible way to express your gratitude and appreciation for the sacrifices made by those who have served our country. This gesture can have a profound emotional impact, demonstrating your commitment to supporting the veteran community and recognizing their contributions. It’s a meaningful way to give back and make a difference in the lives of those who have dedicated themselves to protecting our freedoms.

- Showing appreciation for veteran service

- Fostering a sense of community and support

- Inspiring others to contribute to veteran causes

Top Organizations Accepting Car Donations for Veterans

1. Vehicles for Veterans

Vehicles for Veterans is a nonprofit organization that accepts car donations and uses the proceeds to provide transportation assistance, job training, and other support services for veterans and their families. They work with a network of partner organizations across the country to ensure that donated vehicles are used to make the greatest impact.

2. Disabled American Veterans (DAV) Charitable Service Trust

The Disabled American Veterans (DAV) Charitable Service Trust is a leading non-profit that accepts car donations to fund critical programs and services for disabled veterans. These include providing adaptive equipment, offering vocational rehabilitation, and assisting with transportation needs.

3. Goodwill Car Donation Program

Goodwill’s car donation program allows donors to contribute their vehicles to support the organization’s mission of empowering individuals, including veterans, through job training, employment placement, and community-based services.

4. Vehicles for Change

Vehicles for Change is a non-profit that accepts car donations and uses the proceeds to provide affordable transportation and automotive repair services to low-income families, including those with veteran members.

5. Charity Motors

Charity Motors is a non-profit organization that specializes in accepting car donations and using the revenue to support a variety of charitable initiatives, including programs that assist veterans and their families.

Eligibility and Requirements for Donating a Car

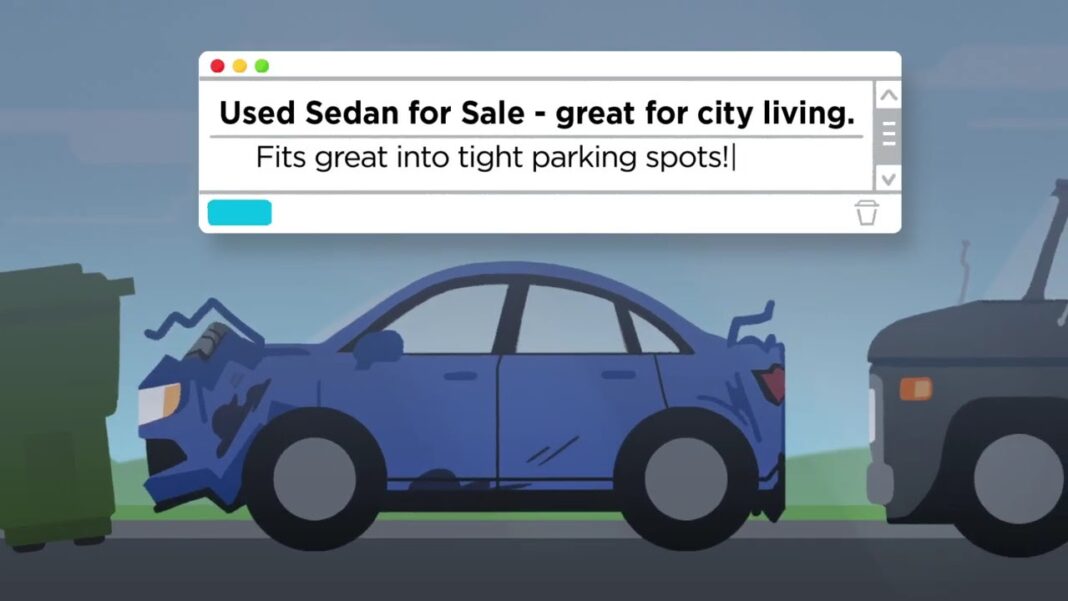

1. Vehicle Condition and Eligibility

When considering donating your car to a veteran-focused organization, it’s important to ensure that your vehicle meets the necessary eligibility requirements. Most organizations will accept cars, trucks, SUVs, and vans that are in running condition and have a current registration and title. Certain organizations may also accept motorcycles, RVs, or boats.

- Vehicles must be in working condition, with a valid registration and title

- Organizations may have specific requirements regarding the age, mileage, or condition of the vehicle

- Some programs may accept non-running vehicles, but the donation process and potential tax benefits may differ

2. Ownership and Title Transfer

To donate your car, you must be the legal owner of the vehicle and have the title in your possession. The title will need to be transferred to the recipient organization, and the donation process will typically involve completing a bill of sale or other necessary paperwork.

- Ensure you have the vehicle’s title and are the registered owner

- Coordinate with the recipient organization to transfer the title properly

- Be prepared to provide personal information, such as your name, address, and contact details

3. Donation Procedures and Timelines

The process of donating your car to a veteran-focused organization can vary, but most organizations have a straightforward and streamlined procedure. This typically involves scheduling a pickup or drop-off time, providing the necessary documentation, and receiving a tax receipt for your contribution.

- Contact the organization to initiate the donation process

- Arrange a convenient time for the vehicle to be picked up or dropped off

- Provide the required paperwork, such as the title and registration

Tax Benefits and Financial Incentives for Car Donations

1. Charitable Contribution Deduction

Donating your car to a qualified non-profit organization, such as a veteran-focused charity, may allow you to claim a charitable contribution deduction on your federal income tax return. The amount of the deduction is typically based on the fair market value of the vehicle at the time of the donation.

- Consult with a tax professional to determine the eligible deduction amount

- Ensure the recipient organization is a registered 501(c)(3) non-profit

- Obtain a detailed receipt or acknowledgment letter from the organization

2. Avoiding Capital Gains Tax

If you choose to sell your car privately, you may be subject to capital gains tax on any profits from the sale. By donating your vehicle, you can avoid this tax liability and potentially receive a larger tax benefit.

- Donating your car can help you avoid capital gains tax

- The tax deduction may exceed the amount you would have received from a private sale

3. State-Specific Incentives

In addition to federal tax benefits, some states offer additional incentives or deductions for car donations to veteran-focused organizations. These may include state income tax credits, property tax reductions, or other financial benefits.

- Research your state’s specific laws and regulations regarding car donations

- Consult with a tax professional to understand the available incentives in your area

4. Donation Value Maximization

To ensure you receive the maximum tax benefit and financial incentives, it’s essential to accurately determine the fair market value of your vehicle at the time of the donation. Organizations that specialize in car donations for veterans can provide guidance on this process and help you navigate the necessary paperwork.

- Work with the recipient organization to accurately assess your vehicle’s fair market value

- Provide relevant documentation, such as the vehicle’s make, model, year, and mileage

- Consult with a tax professional to understand the potential deduction or incentives

Step-by-Step Process for Donating Your Car to Veteran Programs

1. Research and Select a Reputable Organization

Begin by researching various veteran-focused organizations that accept car donations. Evaluate their mission, programs, and track record to ensure your contribution will have the greatest impact. Consider factors such as the organization’s transparency, efficiency, and commitment to serving the veteran community.

- Identify reputable non-profit organizations that specialize in car donations for veterans

- Review the organization’s website, annual reports, and testimonials from donors and recipients

- Ensure the organization is a registered 501(c)(3) non-profit to qualify for potential tax benefits

2. Gather the Required Documentation

Prepare the necessary paperwork, including the vehicle’s title and registration. Ensure that you are the legal owner of the car and have the required documentation readily available.

- Locate the vehicle’s title and registration

- Confirm that you are the registered owner of the car

3. Schedule the Donation Process

Contact the selected organization to initiate the donation process. This may involve scheduling a pickup or arranging for you to drop off the vehicle at a designated location.

- Reach out to the organization to coordinate the donation process

- Agree on a convenient time and location for the vehicle pickup or drop-off

4. Complete the Donation Paperwork

Work with the organization to complete any required donation paperwork, such as a bill of sale or a donation form. Ensure that all necessary information is accurate and that you understand the terms of the donation.

- Review and sign any donation-related documents

- Provide the organization with the vehicle’s title and registration

5. Receive Your Tax Acknowledgment

After the donation is complete, the organization will provide you with a detailed receipt or acknowledgment letter that you can use for tax purposes. Keep this documentation for your records.

- Obtain the tax acknowledgment letter from the organization

- Consult with a tax professional to understand the potential deduction or incentives

6. Follow Up and Provide Feedback

If desired, you can follow up with the organization to inquire about the impact of your donation and provide any feedback or suggestions. This can help enhance the donation experience and ensure your contribution is making a meaningful difference.

- Contact the organization to inquire about the impact of your donation

- Provide feedback or suggestions to improve the donation process

Conclusion

Donating your car to veteran-focused organizations is a profound way to support those who have served our country and make a lasting difference in their lives. By contributing your vehicle, you can provide essential transportation, generate sustainable funding for critical programs, and express your gratitude for the sacrifices made by our nation’s heroes.

Through this comprehensive guide, we’ve explored the top programs for donating your car to veterans, the benefits of such donations, the eligibility and requirements, the available tax incentives, and the step-by-step process to ensure your contribution is both meaningful and efficient.

By taking the time to research and select the right organization, gather the necessary documentation, and navigate the donation process, you can be confident that your car will be used to make a genuine impact on the lives of veterans and their families. Remember, your donation can provide transportation, fund essential services, and demonstrate your appreciation for those who have served our country with honor and valor.